UAE Corporate Tax: Pillar One & Two Explained | OECD, BEPS, GloBE Rules, IIR, UTPR, STTR, & QDMTT

UAE Corporate Tax: Pillar Two Tools Explained OECD, BEPS, GloBE, IIR, UTPR, STTR, & QDMTT RulesПодробнее

UAE Corporate Tax: Pillar One & Two Explained | OECD, BEPS, GloBE Rules, IIR, UTPR, STTR, & QDMTTПодробнее

INTERNATIONAL TAX ACADEMY-Pillar 2 GLoBE Rules- IIR etc.#adit #internationaltax#transferpricing#oecdПодробнее

Pillar One and Two explained in 7 minutesПодробнее

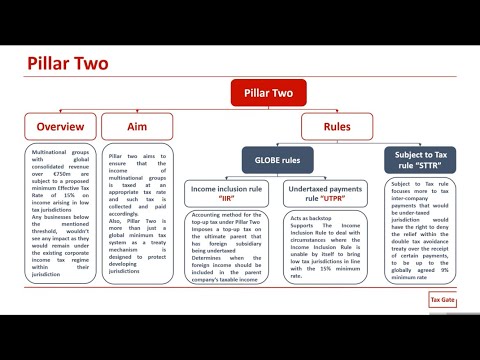

BEPS Pillar Two GloBE Rules - OverviewПодробнее

Deloitte X Taxmann's Live Webinar | Pillar Two – Global Anti-base Erosion Rules [GloBE Rules]Подробнее

![Deloitte X Taxmann's Live Webinar | Pillar Two – Global Anti-base Erosion Rules [GloBE Rules]](https://img.youtube.com/vi/dAwX0_o8viw/0.jpg)

Pillar Two - The GloBE-RulesПодробнее

BEPS 2.0 Pillar Two: International Tax Compliance for Global CompaniesПодробнее

BEPS Pillar Two | global minimum taxПодробнее

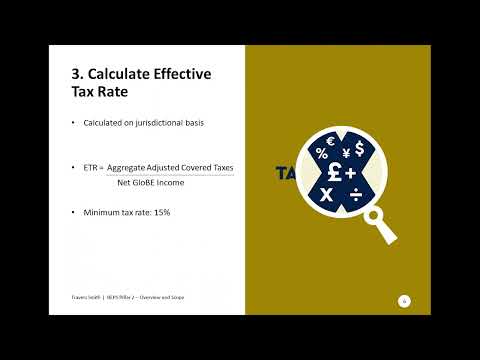

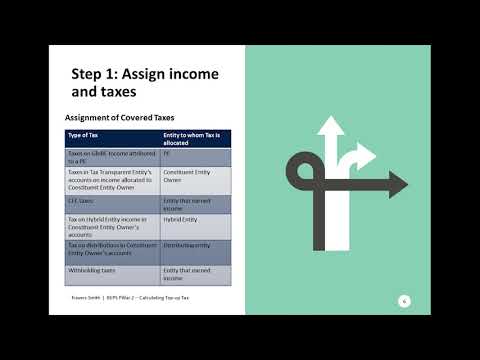

BEPS Pillar Two GloBE Rules - Calculating top-up taxПодробнее

BEPS Pillar Two GloBE Rules - Charging mechanismsПодробнее

OECD BEPS Pillar Two - Robert O'HareПодробнее

GLOBAL MINIMUM TAX RULES IN THE UAEПодробнее

Advancing the Pillars: An OECD Tax Reform Project Update (Audio Only)Подробнее

OECD BEPS 2.0 Two Pillar approach - reforming the international tax system for the 21st centuryПодробнее

OECD Pillar 2: Examples 2022Подробнее

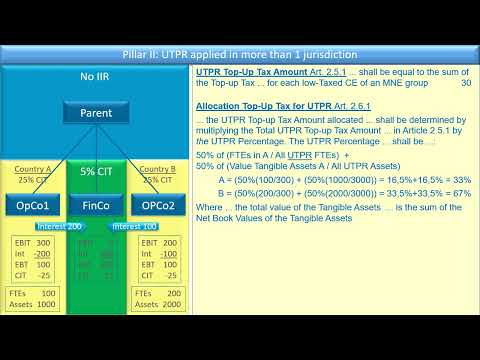

Pillar 2. Allocating UTPR incomeПодробнее

BEPS Pillar 2 is coming: Book accounting considerationsПодробнее